Hopeful investors want to start trading stocks without the added cost of going through a broker that charges trading fees, which eats into profits (gains). They also want the flexibility to trade a diverse set of individual stocks or Exchange Traded Funds (ETFs) to maintain their own portfolio.

Many new products have emerge in the robo-advisor market to meet this demand which offer a variety of features for the average and more experienced investors. To narrow the focus, we’re reviewing two of the top rated robo-advisor products that have grown exponentially in users and managed assets in recent years.

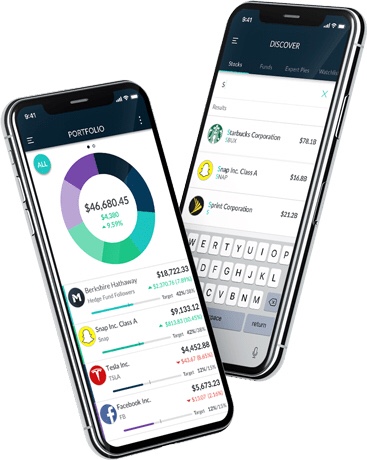

Robinhood (iOS | Android) and M1 Finance (iOS | Android) are both FREE alternatives to the traditional fee-based broker services our parents and generations before used to invest their hard earned dollars. These companies are leading the way in changing and shaping the market for investors of all experience levels.

Full transparency, the reviews below are based on personal experience of investing thousands of dollars and many, many hours utilizing all features from each product. We quite literally have money and time invested in both of these products and hope to share our thoughts to help you find the right solution that meets your investing needs.

Free Robo-Advisor App Comparison

M1 Finance

Pros

- Commission-free trades

- Fractional share trading (percentage based)

- Access to high cost stocks for those with lower funds (e.g., Amazon, Google)

- “Pie Investing” mostly set and forget (with periodic portfolio reviews and rebalancing)

- Tax advantaged selling

Cons

- Mostly DIY stock research outside the tool

- “Pie Investing” may feel restrictive for familiar with traditional trading tools – takes getting used to

- Investment changes not immediate since trades are only initiated once a day (begins at 9AM CST Mon-Fri)

- No tax-loss harvesting

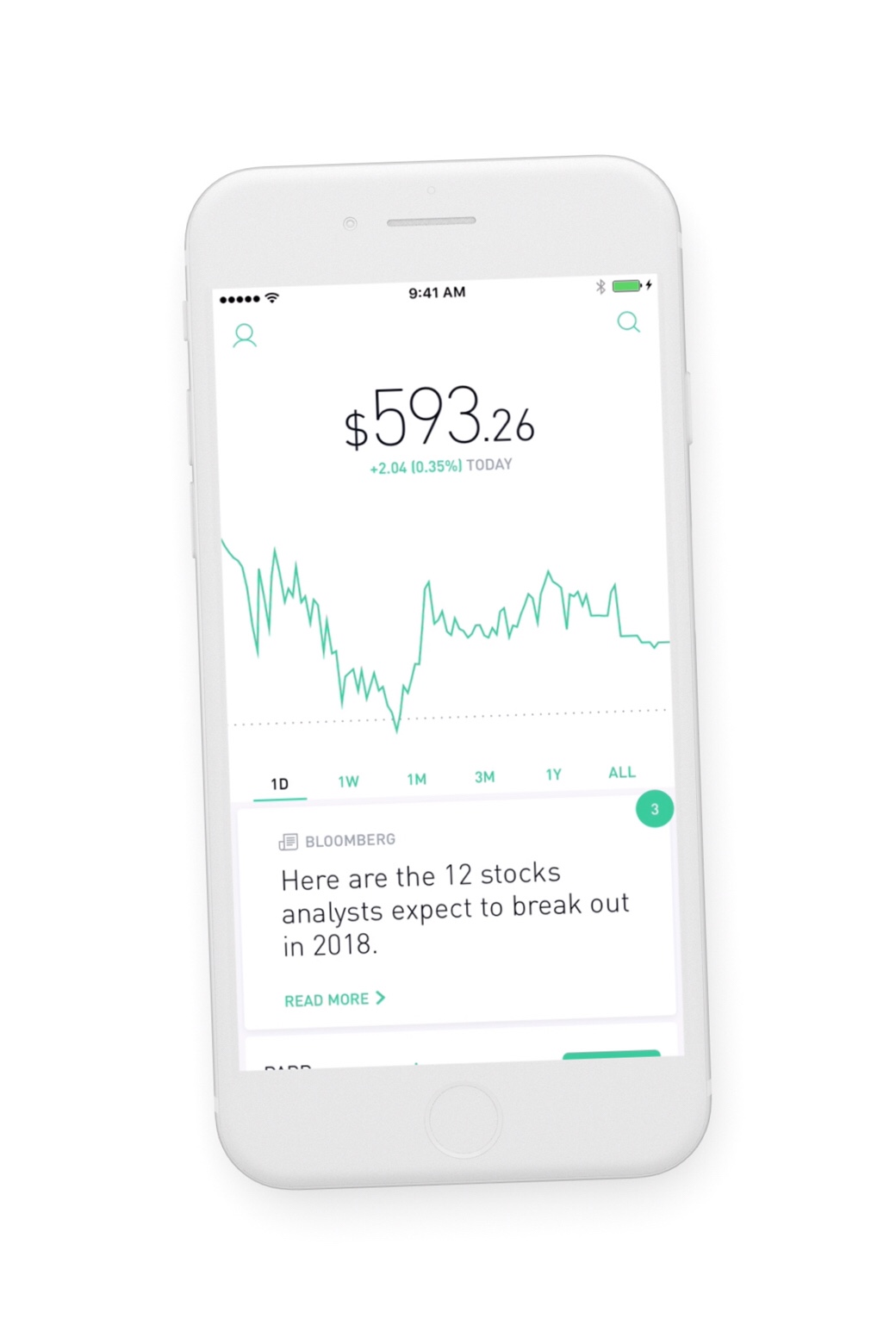

Categories: In terms of investing simplification, both robo-advisor products do this exceptionally well. I had no previous experience with investing (outside of an employer 401k) and was able to pick stocks I had thoroughly researched in a few taps on the screen after depositing funds. For the beginner investor, the greatest challenge with M1 Finance will be the upfront research and deciding what % of your portfolio to allocate to each stock or ETF. The good part about the simplified offering is that you don’t need to worry about all the other investing jargon like put spreads, call spreads, options, bid, etc. While Robinhood does have these more advanced features, they are only there if you really need them. The rest of it is fairly straightforward when it comes to purchasing shares of stocks you’re interested in. Advantage: M1 Finance This category will be very light given most of your research will need to be done outside these free robo-advisor products. While both offer some investment themes to browse, neither has much in the way of research and analysis capabilities. However, Robinhood’s web-based version of their product does offer some features to search for stocks based on popularity (# of Robinhood users with that stock), analyst buy rating, and various criteria to sort/filter on. They do expect to roll these features out to mobile, but that timeline is unknown as of this post. Advantage: Robinhood (web/browser access only) The main interface for the Robinhood mobile app is well thought out with a nice trend chart, portfolio numbers (total value, change in % or $, and useful “cards” that provide reports on yours and other relevant stocks. The M1 Finance interface is a little less involved with a view of your portfolio “pie” and all of the”slices” that make up your portfolio below. For those wanting a quick view of their investments, both apps do this with nicely simplified interfaces. Overall, the visuals and user experience with these two robo-advisors is exceptional and provides access to key information on your portfolio and investments. Advantage: Robinhood In terms of access to equities and ETFs, both robo-advisors have broad access to most US stocks that are traded in the major US stock exchanges. One big difference is that Robinhood is starting to offer crypto-currency trading for investors residing in certain states. When it comes to features related to buying/selling, M1 Finance is as simple as it gets with pie investing to allocate a % of your portfolio to a stock. This is a great concept for those interested in long-term investing. However, if you want or need more features like Options (put spreads/call spreads), after-hours trading, or intra-day trading, then Robinhood is the choice for you. Additionally, if you’re looking for retirement savings account options, you’ll want to consider Wealthfront or Betterment for those needs. Advantage: Robinhood Robinhood and M1 Finance are both commission free robo-advisors. Robinhood does offer a subscription service called Robinhood Gold which essentially gives you access to extended hours trading (after market close) and more “buying power”. Fair warning, the latter can be risky since you are essentially using lended money to buy stocks. In short, it’s hard to beat commission free trading that both Robinhood and M1 Finance offer. Advantage: Tie Robinhood and M1 Finance both have a wide array of features that appeal to beginner or experienced investors. Understanding your particular level of engagement and desire to be hands-on with your portfolio will help to determine which commission free robo-advisor better fits your investing preferences and lifestyle. M1 Finance is recommended for: Start investing with a free $10 credit (exclusions may apply) Robinhood is recommended for: Start investing with a FREE share of stock (exclusions may apply) Full Disclosure: The above promotions are referral links from each company associated with the author’s account. When you use the links provided, they will receive a referral commission. Once you sign up, you will also be able to refer friends and family to start their investing journey too! Happy Investing!Robinhood

Pros

Cons

Detailed Free Robo-Advisor App Review

EASE OF USE

RESEARCH TOOLS

DASHBOARDS & TRACKING

INVESTMENT OPTIONS

PRICING

Recommended Free Robo-Advisor App