Whether you’re planning for retirement, saving for future college tuition, and/or opening an investment account, there are a large number of brokers to decide between. Most of the large brokers are moving closer to an average of $4.95 in trade commission fees, but there are some upwards of $19 per trade. However, this is just one common type of fee charged. You should also investigate whether there are any additional annual account fees, expense ratios (mutual funds, index funds, and ETFs), advisory fees, or 401k administration fees when considering these types of firms. When you factor in those additional expenses, the long-term impact on your returns can really add up.

For example, say you invested $400 per month over 30 years for a total contribution of $144,000. Assuming an annual average market return of 7% and expense fees of just 1.0%, your account value would be worth $675,695 after 30 years. That’s great right? Well, it could have been even better. Over those 30 years, you would have paid $100,269 in fees, which means not only are you out that money, but it’s money that could have grown if it was invested instead.

You’re probably asking, can I completely eliminate those fees? The answer is most likely not since you’re purchasing a service to manage your investments. However, if you invest wisely with a robo-advisor product, your overall fees can be greatly reduced.

Two great robo-advisor products we will be comparing today are Wealthfront and Betterment. Both charge a flat annual fee of 0.25% (excluding add-on services) and are a great alternative to the traditional offerings which often charge a variety of fees to manage your investment portfolio. Similar to Robinhood and M1 Finance (see our reviews here), these companies are forcing their industry peers to rethink the products and associated fees they bring to market for potential customers.

Quick note, the reviews below are based on personal experience of investing my own dollars along with many, many hours utilizing and researching these products. As always, we hope to share our experience and thoughts to help you find the right solution that meets your investing needs.

Robo-Advisor Comparison

Wealthfront

Pros

- Low 0.25% annual fee. No commission fees. First $10,000 managed for free

- Wide range of account types: Individual, Joint, Trust, Traditional IRA, Roth IRA, SEP IRA, 401(k) Rollover, 529 College Savings

- Diversification based on risk tolerance

- Automated portfolio re-balancing

- Tax-Loss Harvesting

Cons

- $500 minimum deposit

- Limited range of index funds or ETFs

- No ability to invest in individual stocks

Betterment

Pros

- Low 0.25% annual fee. No commission fees. Offers promotions for free management for up to one year based on deposit amount

- For an additional 15% once you reach a $100,000 minimum balance, you can access a financial advisor for guidance outside of you Betterment investments (e.g., home buying, wedding, college saving, retirement)

- Diversification based on risk tolerance

- Automated portfolio re-balancing

- Tax-Loss Harvesting

- No minimum account balance

Cons

- Does not offer a 529 College Savings plan

- Limited range of index funds or ETFs

- No ability to invest in individual stocks

- Betterment mobile app not the most user friendly

Detailed Robo-Advisor Review

Categories:

- Ease of Use

- Planning Tools

- Dashboards & Tracking

- Investment Options

- Pricing

EASE OF USE

Wealthfront and Betterment are considered robo-advisor products for a good reason. The investment models behind these products take care of most of the hard work after depositing funds into your account and selecting a risk tolerance level that’s appropriate for your age, lifestyle, preferences, and goals. They will automatically select a mix of ETFs and bonds based on your risk profile, take care of portfolio re-balancing, and perform tax-loss harvesting to potentially save money on your tax bill.

One difference between the two from a usability standpoint is that Wealthfront’s mobile app seems to have a majority of the functionality available in the web version, excluding setting your risk score. Betterment has most features in the mobile app as well, but a good amount of the planning and what-if analysis can only be done using a web browser.

Both products are easy to use, however, Wealthfront has an edge with a more useful and well-rounded mobile app experience.

Advantage: Wealthfront

PLANNING TOOLS

Overall, the planning tools across Betterment and Wealthfront are fairly equal and try to account for the many uncertainties or variables (interest rates, cost inflation, average market returns, etc.). Some of the planning questions both will assist you in answering:

- What is my projected net value when I plan to retire? What if I want to retire early?

- What is my total value across all of my 401k or IRA accounts? (both require synching with external account owners)

- What happens to my retirement and other financial goals if the market takes a hit?

- How much do I need to save in the next X years to put a down payment on a house, purchase a car, take a vacation, etc.?

Wealthfront also offers planning for future college expenses, which Betterment does not currently. Wealthfront can help you estimate the future cost of college tuition and suggested savings to help cover the costs for yourself or a family member.

Overall, you will have access to outstanding planning tools through either Wealthfront or Betterment. You will have the most optimal experience using the web browser, however, Wealthfront has more planning features built into the mobile app where Betterment requires you to switch to the browser for any meaningful analysis.

Advantage: Wealthfront

DASHBOARDS & TRACKING

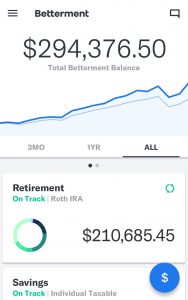

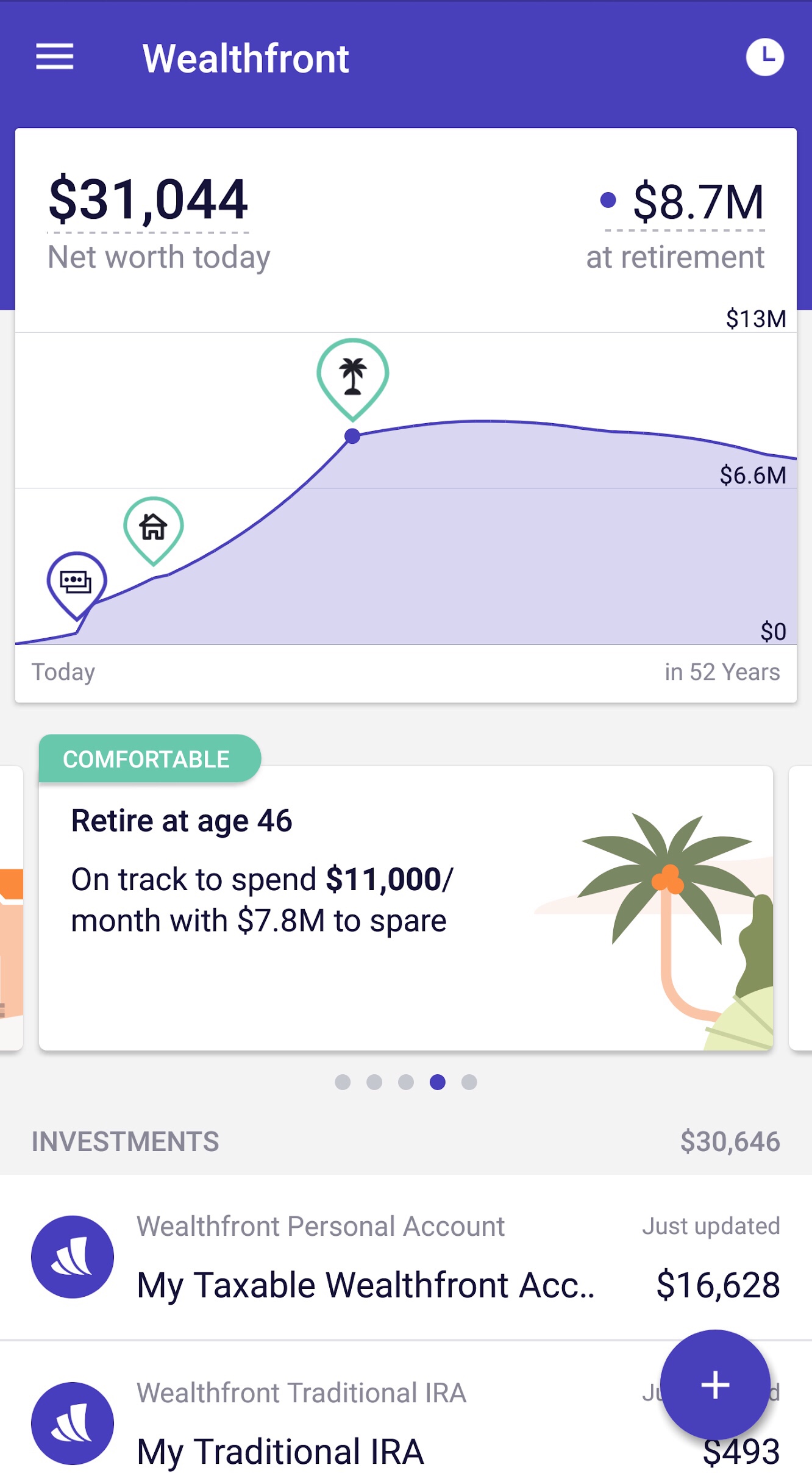

The first thing you see with both Wealthfront or Betterment is a view of net worth today and a projection for retirement to help determine whether you are on track.

Betterment Mobile App

In Wealthfront, you can even use a quick slider on the chart to see the impact on your future net worth of shifting retirement earlier or later.

In addition, both provide a snapshot across your Wealthfront or Betterment and any linked external accounts so you can stay on top of your investment balances. Wealthfront also let’s you track assets like your house which pulls an estimate of your home’s value from Redfin and liabilities such as credit card or loan debt. This isn’t a critical feature given the variety of personal finance tools available (see review here), but it’s nice to see the full picture of where your net worth is at today.

Advantage: Wealthfront

INVESTMENT OPTIONS

Both Wealthfront and Betterment provide a wide range of account types including: Individual, Joint, Trust, Traditional IRA, Roth IRA, SEP IRA, and 401(k) Rollovers. Your funds are automatically invested in a diversified mix of ETFs which have a range of fees (lowest is generally 0.4%). While the fund providers may differ between them (Vanguard, Wells Fargo, etc.), the overall performance and returns is going to be comparable.

However, Wealthfront also offers a 529 College Savings which can help build enough savings to pay for part of your children’s or your own college tuition. This is a big investment for most and can be a drain on finances later in life, so it’s wise to start saving for this investment early.

If the 529 College Savings plan isn’t something you require, then you’ll be safe to go with either Wealthfront or Betterment when it comes to investment options.

Advantage: Wealthfront

PRICING

Both Wealthfront and Betterment charge a flat rate of 0.25% on your total balance for an annual management fee. However, Wealthfront offers the first $10,000 managed free and Betterment has a promotion for up to one year of free management based on deposit amount. For an additional 0.15%, Betterment provides access to a financial advisor to help you with your investments and other financial planning (e.g., retirement, buying a house, college tuition).

Advantage: Tie (Wealthfront is better for new investors with $10,000 or less to invest)

Recommended Robo-Advisor

If you have at least $500 to deposit, we highly recommend going with Wealthfront for your investment needs. It has by far one of the most intuitive user interfaces and offers various tools to help plan for future events, goals, and retirement.

However, if you don’t have $500 and new to investing, Betterment is a great alternative to get you started.